Does it cost a guest to go to a wedding?

Posted on

Have you been to a wedding this summer? Did you find that being excited for the couple is one thing and then you realise that it might be quite costly for you and your family to attend as a guest?

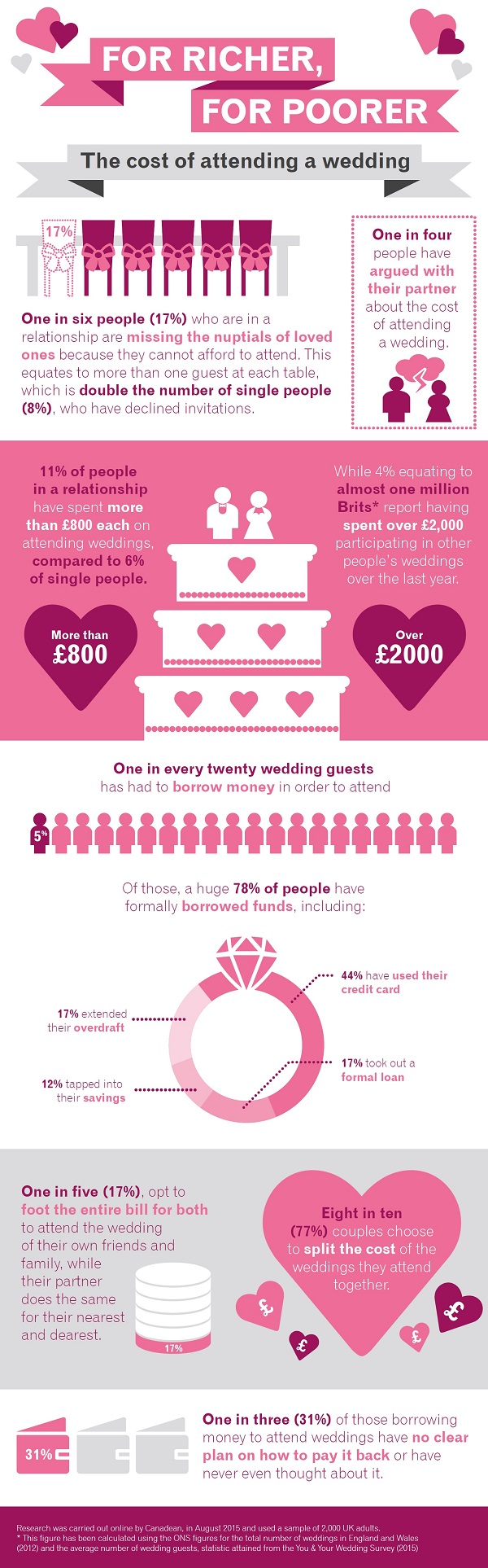

We have two weddings to go to this year, one in the Autumn and one on New Years Eve and whilst the latter helps us to solve the "what are we doing for New Years Eve debate" it also means hotels, outfits and gifts straight after the expense of Christmas. We are firm believers in never arguing about money but it is quite sad to see that one in four Britons has argued with their partner about the cost of watching others say "I do"

There has been a recent survey by Experian’s that suggests the rising cost of weddings is rocking the boat for many couples, and not just for the bride and groom. In fact, almost a quarter of Britons (22%) have argued with their partner about the cost of witnessing others tie the knot. Eek!

Experian have highlighted some top do's and don'ts for financial harmony, which I think is great advice for any frugal family.

Do

- Set the ground rules. Do you want a joint account for regular expenses and separate bank accounts for personal spending? Or do you want everything to go together?

- Work out who does what. The more frugal partner could look after the budget, while the more extravagant works out the ‘treats’, like meals out or trips away

- Agree on short and long-term goals and how you’re going to achieve them, and review regularly together

- Be honest about your past. If you have a less-than-perfect history of repaying money you owe, this could affect both of you in the long-term if your credit reports become linked

- Take time together to understand if you need to improve one or both of your credit reports. Do this well in advance of applying for credit together

- Spend all your time together talking about money

- Keep secrets. Research from Experian shows that 29% of people in the UK discovered that their partner was keeping credit card debt from them

- Dig yourself into a hole. If you find yourself in debt, don’t borrow more in the hope of putting things right. Ask for help and be open about it with your partner

- Talk about money issues when you are angry. Arguing about money is never going to be productive

- Expect your partner to completely change. It’s unlikely an extravagant spender will do a complete about-turn and suddenly become frugal

Managing your finances and your relationship can be quite a balancing act – when it comes to both organising and attending weddings, moving in together or just life in general. That’s why Experian have created a dedicated Money & Relationships Guide to help people understand what we know can be quite a complex series of topics – in jargon-free, easy-to-understand language. All of the guides are available online. Hopefully these guides will be helpful for you and your followers who are trying to get their heads around how credit referencing works, and the good, the bad and the surprising when it comes to managing your finances to get what you want in life.

Add a comment: